by Anna Meadows, Sycamore Research — 26 April, 2023

Recently I went to see The Fabelmans at my local cinema with friends. The screening of Spielberg’s semi-autobiographical ‘love letter to cinema’ begins with an introduction from the icon himself in which he thanks the audience for coming to watch his work on the big screen. A gentle murmur of agreement spread throughout the audience as the Director pointed to the joy of a shared viewing experience. At the end of the movie the audience all applauded. Recalling favourite moments and critiquing performances we all left the theatre chattering about what we’d just seen. He’s right – watching and discussing movies with others is a fulfilling experience.

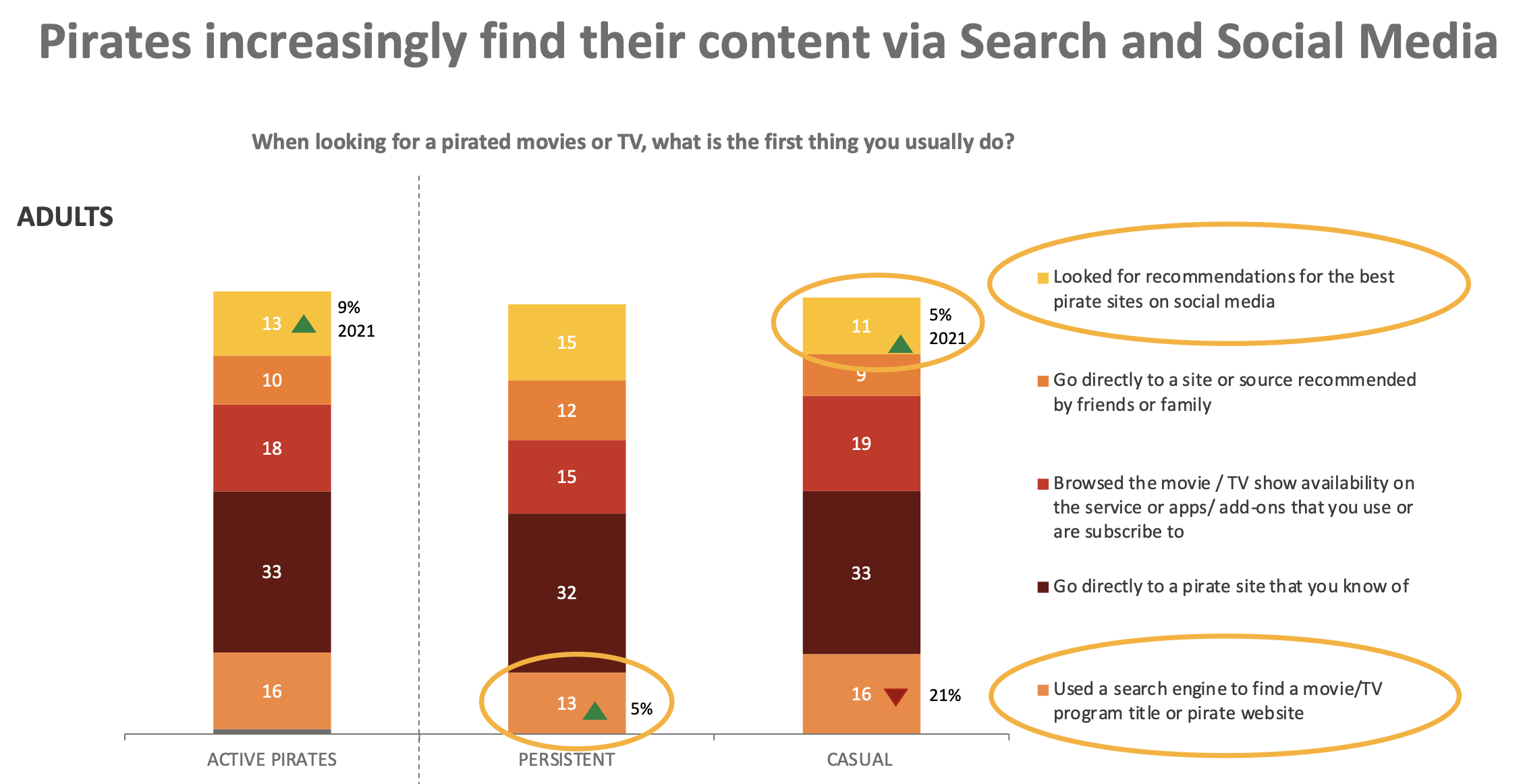

Research has demonstrated that shared experiences are more enjoyable than solo ones and have the ability to amplify emotions. Amazon’s Watchparty or Chrome’s Teleparty have tapped into this human motivation for social connection with reported success. This is why it is not a surprise that the most recent round of Creative Content Australia’s research into Australian piracy behaviours showed a marked shift in both the seeking and watching of pirated content via social channels (a jump from 5% to 11% of casual adult pirates reporting looking for recommendations via social media channels and a similarly significant increase in teens streaming and watching on social platforms). This innate drive to connect and share is not lost on Pirate operators who are increasingly using Facebook Groups to reach consumers. A cursory search on TikTok similarly reveals a wealth of recommendation and instruction. What is interesting though is that of those who have streamed pirated content on social media platforms, only one third consider themselves pirates. As we know from research on social norms, if those around us are doing something it suggests that it is the right thing for us to do too. One has to question therefore if the proportion of Australians claiming to participate in piracy is higher than it may initially appear from the reported behaviour data. 21% of adults and 23% of teens claim to be active pirates and a growing number of teens claiming to have never pirated (from 59% in 2021 to 65% in 2022).

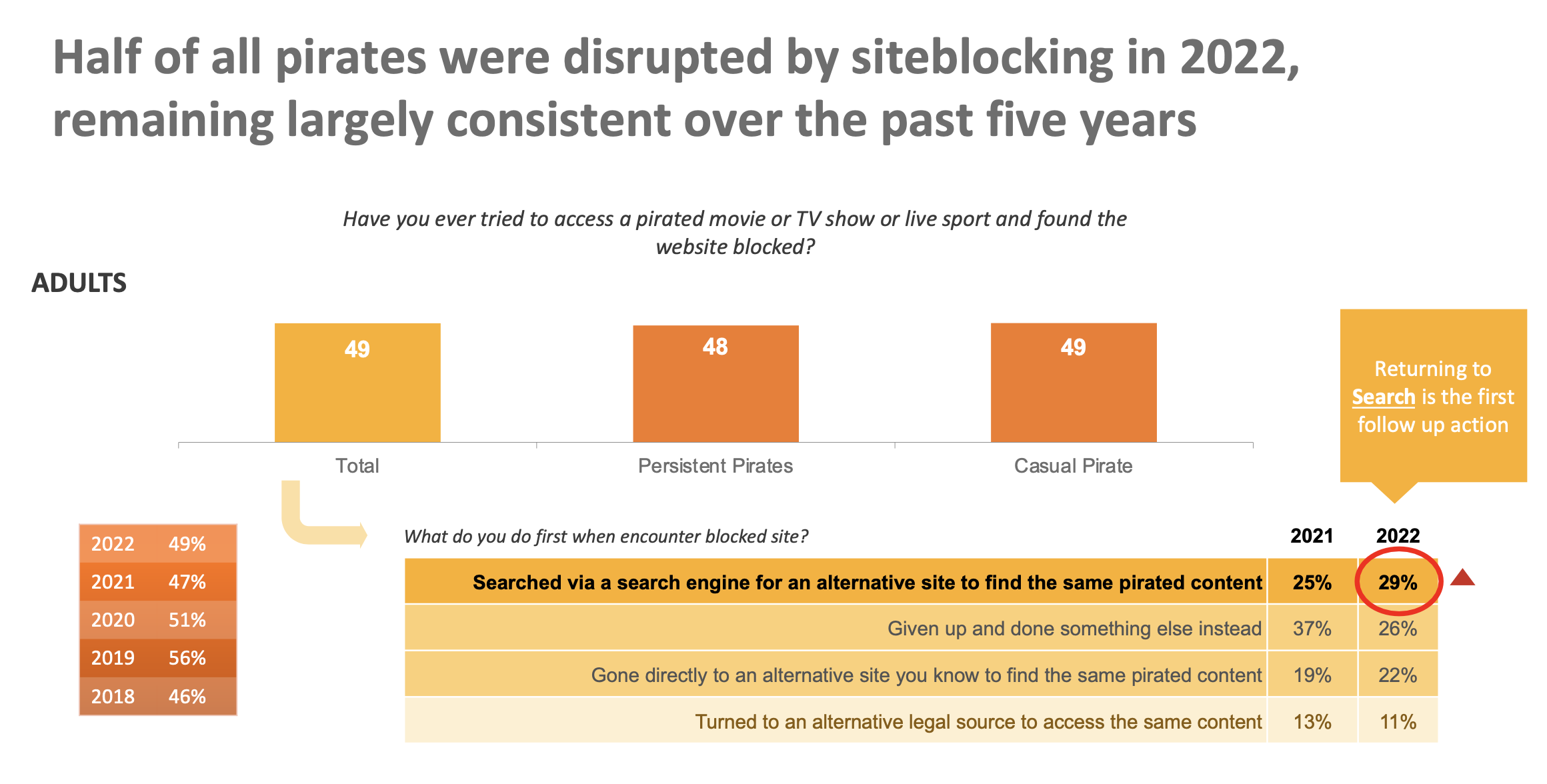

There are of course other factors that are pushing back against piracy behaviours which are revealed by other responses to the CCA survey. For example, another truism of human behaviour is that we tend to avoid anything that is effortful. When weighing up the benefit of watching a pirated movie or TV show, individuals will consider the amount of time and effort required to find what they want. This is a barrier to accessing pirated content that has grown in significance for both adults and teens (to 32% and 27% respectively). Most also say that they find that they have sufficient access via their paid subscription channels, which of course are devoid of the hurdles of site blocking which disrupted half of all pirates in 2022 in their search for content. Whilst 29% of those who have been tripped up by a block say that they search for the same content elsewhere, over a quarter don’t make the effort. This was also a finding of the 2022 Attorney General’s consumer survey on Online Copyright Infringement which states 60% simply gave up in the face of a blocked site. Add that to the barriers in the form of the risk of viruses, ransomware and other cybercrime, which have been experienced by both adult and teen pirates at increased levels year on year, and it becomes easier to see why piracy also is likely underreported but also currently a less attractive option.

What will be interesting to see is how these barriers fare in the face of the evolving global economic context. The cost-of-living crisis is starting to bite in Australia, and this may put pressure on legal channels. In other markets, rationalisation of subscriptions has taken place as individuals cut their discretionary spending. In the second quarter of 2022 Kantar showed Australian households with under 25s present saw a steep decline in subscription to at least one streaming service with 666,000 SVOD services cancelled, 37% of those doing so citing the need to save money. The CCA data also shows a similar pattern, with some limited growth for the powerhouses of Disney+ and Amazon Prime amidst an overall slowing in uptake across providers. Half of all respondents point to an oversupply of services and 37% state an intention to cut back. Most (72%) are unaware of the rumoured upcoming crackdowns on password sharing by the major SVOD services and, if implemented, this will undoubtedly put piracy back in the consideration set for some of those who have lapsed. It’s a situation that requires monitoring as the balance of effort may well start to shift again with greater motivation for illegal, yet cheaper sources of content.

Ultimately, most of us want a quality viewing experience and preferably a shared one and individuals will balance this against the personal cost of achieving that experience. Fortunately, creators continue to provide wonderful and desirable content that is still best accessed via legal channels. New and exciting releases such as Maverick and Avatar have enticed audiences back to the cinema in 2022, particularly teens, and with that comes positive social and emotional benefits – which post pandemic we all value more than ever. Surely that will put a smile on Spielberg’s face too?

Anna Meadows has over 20 years of multinational experience in advertising, market research, marketing and behavioural science consultancy. Anna has worked with some of the world’s largest companies devising and implementing large qual and quant research projects and developing communications strategies for their many brands. Anna lived and worked in APAC from 2000-2017 as Client Service Director at Lowe Advertising in Australia and then as Director and Head of Qualitative at Millward Brown Firefly and founder of Sycamore Research in Singapore. She is now based in the UK (Cambridge) and works between markets. Anna has a Master’s degree in Behavioural Science from the London School of Economics, is a Qualified Practitioner of Market Research with the Australian Social and Market Research Society and a member of The Association for Business Psychology. Anna’s focus is in the analysis of consumer behaviour and applied behavioural science.